A lot has happened over the past two years. COVID-19 spread across the world, governments shut down society, hundreds of millions were thrown into economic hardship, etc. Starting in March of 2020, the federal government passed several massive “stimulus” bills that sent cash directly to Americans. Congress paid little attention to the cost. Now, we are starting to see the fallout: inflation.

You’ve probably been seeing it for at least a few months now. Gas costs more. Groceries are more expensive. Everyday items are more costly each week, it seems. It turns out that the inflation rate this year is an astounding 6.8%, the highest since1982.

You’re not going crazy and you’re not the only one noticing and feeling the pain.

Inflation is here, there is no question about it. But why are we experiencing this? The answer is ultimately fairly simple in a complex world: excessive money printing.

The Monetary Nature of Inflation

Milton Friedman once said, “Inflation is always and everywhere a monetary phenomenon.” It may seem rather obvious, but Friedman’s point is that when inflation takes place, it is because of the manipulation of the monetary system.

In ancient cultures, currency was inflated by diluting the silver or gold content of the coins and mixing in other metals. With less precious metal making up the coins’ composition, they became less valuable, and more became necessary to buy life’s necessities.

In modern times, central banks print paper dollars (fiat currency), and cause each individual dollar’s value to go down. The more of any resource there is, the less valuable each unit of that resource is. Money is no exception.

One of the most notable examples of inflation is Weimar Germany 100 years ago. After the first World War, the Allied Powers placed the entire war debt onto Germany. In order to pay the outrageously massive debt, the central bank printed copious amounts of marks.

Inflation in Weimar Germany got so bad that people were taking wheelbarrows of Marks to buy basic things like bread. The mark depreciated to 160,000 to the U.S. dollar on July 1, 1923; 242,000,000 to the dollar on October 1; and 4,200,000,000,000 to the dollar on November 20.

It was a very scary time. The financial crisis was one of the primary circumstances that enabled Adolf Hitler and the Nazis to rise to power.

What’s Happening with Inflation Right Now?

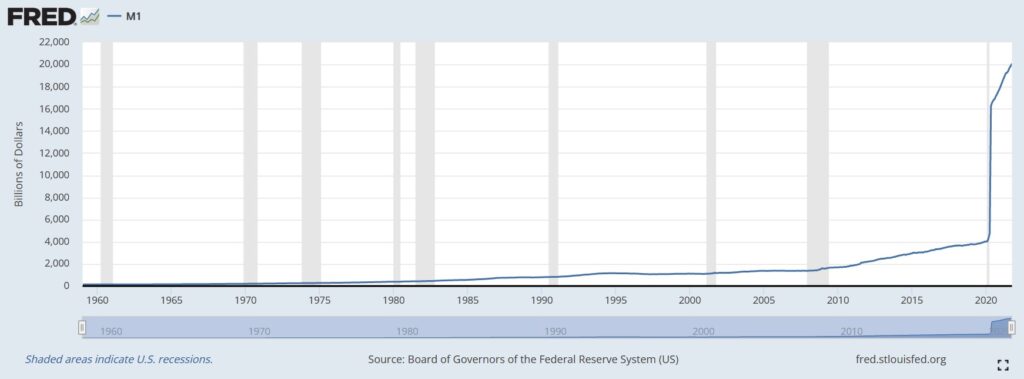

The Federal Reserve has printed a huge amount of dollars over the past two years. Federal Reserve Bank data shows that as of March 2020, there were about 4.2 trillion U.S. dollars circulating. But by October 2021, that number shot up to an astounding 20 trillion.

This is why inflation is happening. It’s not so much that the cost of goods is going up, but rather that the value of the dollars is going down. A less valuable dollar means more dollars are necessary to purchase the same good or service.

Some politicians, including top officials at the Federal Reserve, have tried to dismiss inflation as “transitory.” This would mean that the inflation rate is going to spike for a short time and then settle back down to the target rate.

But how can such a massive increase in the money supply (one that is still happening) cause merely transitory inflation? Is that why we’re seeing articles about how inflation is now “good for us”?

On top of the monetary problems are supply chain issues, as well. There are staffing shortages across the entire country. Factories cannot produce enough goods. Truckers are hard to find. And stores cannot keep staff on hand to keep up with demand.

That also puts upward pressure on prices. As demand goes up and supply goes down, prices go up. Adding this on top of the effect of greater inflation, and we really have some serious economic problems going on.

And I fear we’re just getting started.

Who’s Really Hurting from Inflation?

Almost everyone is worse off from inflation. There are some people who benefit from it, including those connected with the political class. But for everyday people, and even those of modest wealth, inflation is really a stealthy form of theft.

Because of the marginal utility of money, people of lower socioeconomic status are harmed the most. One dollar has a greater proportional value for someone who makes $40,000 a year than for someone who makes $400,000 a year.

When that dollar purchases less, the person of lesser means takes most of the hit. The person who makes $400,000 has more financial resources to absorb the increased cost of goods and services. The person of lesser means does not.

What Can We Do About It?

Our recommendation for everyone, regardless of economic conditions, is to manage money in the ways that God teaches. These are things like avoiding debt, having an emergency fund, planning your spending, and being generous.

But especially when tough times are coming down the pike, there is all the more reason to do the right things right now. Follow these Biblical principles. Wisely steward what God has given you, as the two servants did with the two and five talents.

In addition to this, share this knowledge with your friends and family. They may be confused and frustrated by the fact that everything is increasing in cost. If they do not understand why they won’t be able to confront the problem with the necessary knowledge to fix it.

We need to speak out to our elected officials and demand accountability at the Federal Reserve. The extreme printing of money has to stop. The unbridled spending sprees have to stop. And we have to allow the correction to take place that has been pushed off for so long.

After locking down society for months, it became inevitable that there would be severe economic consequences. Our government has tried to push this off into the future and pretend that the laws of economics can be ignored. But their folly will be their (and our) downfall.

Inflation is here and we have to take action to stop the stealing of our savings and purchasing power. You now have the knowledge. Share this with others and spur them to act as well.

Great content! Keep up the good work!