Congress recently passed, and President Biden signed, another stimulus bill to give Americans more money after the fallout of shutting down much of our economy over the past year. The bill’s total cost will be $1.9 trillion and will include more EIP’s (economic impact payments), unemployment compensation, and a higher child tax credit, among other provisions.

In a rush to get something passed, it seems one question was overlooked: what will be the long-term impact of this?

Contrary to what the media and many governments would have us believe, COVID-19 is not the only big problem we have in our society. As this disease manages to stick around, we have also seen a massive surge of unemployment, drug overdoses, and suicides (especially among children).

And on top of that, the three massive spending bills passed have added several trillion to the national debt. It seems that number (over $28 trillion as of today) has been completely ignored in the midst of all this. But it can only be ignored for so long.

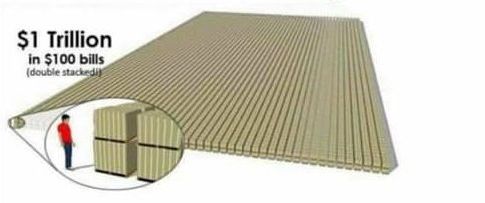

What is concerning is how flippantly the politicians are treating these numbers. They throw around $2 trillion as if it’s just any old credit card bill. There is no real understanding of how much $1 trillion is, let alone $28 trillion, going on $30 trillion.

How much is $1 trillion?

Let’s put things this way: If a person spent $1 million every single day from the time of Jesus Christ (let’s just say 0 B.C.) to the present day, that person will still not have spent $1 trillion. The total is about $737.6 billion through the year 2021.

It would take nearly 2,729 years to spend $ trillion at a rate of $1 million a day. To spend $1.9 trillion, the cost of the latest stimulus bill would take 5,205 years.

And to spend $28 trillion at a rate of $1 million a day? 76,712 years (longer than our world has existed).

Let those numbers sink in for a moment. 2,729 years for $1 trillion, 5,205 for $1.9 trillion, and 76,712 for $28 trillion.

What is our government doing with these “stimulus” bills?

We understand that many people are experiencing the effects of an economic shutdown. To alleviate the effects, we must also ask logical questions. What type of future is being created for young adults and our children? This debt is not simply going to disappear. And the ones who created it will undoubtedly be long gone when it comes due.

As Thomas Sowell has so aptly stated, there are no solutions, only tradeoffs. But some tradeoffs are far more costly than others. And at some point, our children and grandchildren will pay the price for these decisions. What will it be? Destruction of the dollar’s value? Extreme levels of taxation? War?

What can we do?

Fiscal responsibility is for all Americans to be concerned with. As Christians we want to see the federal government be good stewards of the money that God has provided us all with. We cannot sit back and be complicit with the uncontrolled spending, even if the alleged intention is more economic stimulus. We need to act.

This is where Christians can get involved by writing their representatives and showing up to participate at a local level by voting and voicing their concerns. We also need to be in prayer for our leaders to make good decisions. Ultimately, this shouldn’t be a partisan issue. Rejecting the march to financial slavery is not a Democrat or Republican issue; it’s an American one.

While I understand that there needs to be economic relief for some people being affected by economic shutdowns, adding trillions more in debt will be something we will look back on and say, “We did the right thing”?

I doubt it. We should instead be focusing on a mission’s model within the churches by seeking to identify and meet the needs of others who are struggling during this time. If we truly modeled generosity, we wouldn’t have a need for the federal government to bail us out.

At The Financial Apologist, we offer counseling for anyone who is in need. Please reach out to us so that we may help you!